Net sales increased 29% to $1,411.0 million, compared to $1,091.7 million in the prior year.ĭTC channel net sales increased 35% to $784.7 million, compared to $580.9 million in the prior year period, driven by both Drinkware and Coolers & Equipment. Net income increased 17% to $72.9 million, or 16.4% of net sales, compared to $62.4 million, or 16.6% of net sales in the prior year quarter Net income per diluted share increased 15% to $0.82, compared to $0.71 per diluted share in the prior year quarter.Īdjusted net income increased 19% to $77.4 million, or 17.5% of net sales, compared to $65.2 million, or 17.4% of net sales in the prior year quarter Adjusted net income per diluted share increased 18% to $0.87, compared to $0.74 per diluted share in the prior year quarter.įor the Twelve Months Ended Janu(52 Weeks) Operating income increased 15% to $93.7 million, or 21.2% of net sales, compared to $81.4 million, or 21.7% of net sales during the prior year quarter.Īdjusted operating income increased 18% to $99.8 million, or 22.5% of net sales, compared to $84.5 million, or 22.5% of net sales during the same period last year. As a percentage of net sales, SG&A expenses decreased 190 basis points to 36.3% from 38.2% in the prior year period, primarily driven by lower planned marketing expenses, partially offset by higher variable expenses. Selling, general, and administrative (“SG&A”) expenses increased 12% to $161.1 million, compared to $143.4 million in the fourth quarter of 2020.

The 230 basis point decrease in gross margin was primarily driven by higher inbound freight rates, the unfavorable impact of the non-renewal of the Global System of Preferences (“GSP”) program on import duties and product input cost inflation, partially offset by lower inventory reserves.

Gross profit increased 13% to $254.8 million, or 57.5% of net sales, compared to $224.8 million, or 59.8% of net sales, in the fourth quarter of 2020. Wholesale channel net sales increased 13% to $179.2 million, compared to $158.0 million in the same period last year, primarily driven by Drinkware.ĭrinkware net sales increased 21% to $285.6 million, compared to $235.7 million in the prior year quarter, primarily driven by the continued expansion of our Drinkware product offerings, including the introduction of new colorways and sizes, and strong demand for customization.Ĭoolers & Equipment net sales increased 13% to $151.6 million, compared to $134.3 million in the same period last year, driven by strong performance in bags, outdoor living products, hard coolers and soft coolers. The DTC channel grew to 60% of net sales, compared to 58% in the prior year period. Net sales increased 18% to $443.1 million, compared to $375.8 million during the same period last year.ĭirect-to-consumer (“DTC”) channel net sales increased 21% to $263.9 million, compared to $217.8 million in the prior year quarter, driven by strong performance in both Drinkware and Coolers & Equipment. Looking forward, as we continue to maneuver through the varied supply chain disruptions and pressures, I remain incredibly confident in the demand for the YETI brand.”įor the Three Months Ended Janu(13 Week Period) This performance was capped by fourth quarter net sales growth of 18%, exceeding the high-end of our outlook despite the many supply chain challenges facing the entire industry. We drove demand across our omni-channel with 35% growth in our DTC business, delivered strong performance in both our product categories of drinkware and coolers and equipment, and approached a 10% international sales mix. Today we are reporting nearly 30% net sales growth, adjusted operating margin expansion to approximately 21%, and balance sheet strength with over $300 million of cash on hand.

Matt Reintjes, President and Chief Executive Officer, commented, “2021 was an incredible year for YETI, achieving several milestones during our fourth year as a public company. Please see “Non-GAAP Financial Measures,” and “Reconciliation of GAAP to Non-GAAP Financial Information” below for additional information and reconciliations of the non-GAAP financial measures to the most comparable GAAP financial measures. YETI reports its financial performance in accordance with accounting principles generally accepted in the United States of America (“GAAP”) and as adjusted on a non-GAAP basis. The 13-week fourth quarter and 52-week fiscal year ended Januare compared to the 14-week fourth quarter and 53-week fiscal year ended January 2, 2021. (“YETI”) (NYSE: YETI) today announced its financial results for the fourth quarter and fiscal year ended January 1, 2022.

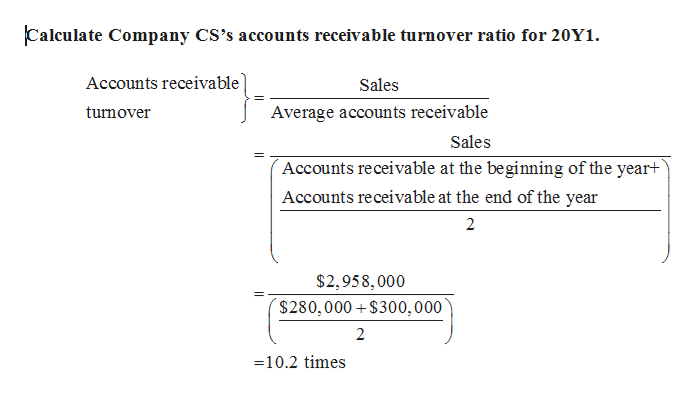

#Yeta account receivable turnover ratio. full

Fourth Quarter Net Sales Increased 18% Full Year Increased 29%įull Year Operating Margin of 19.5% Adjusted Operating Margin of 20.9%įourth Quarter EPS Increased 15% Adjusted EPS Increased 18%įull Year EPS Increased 36% Adjusted EPS Increased 37%

0 kommentar(er)

0 kommentar(er)